Bank of England deliver early Christmas present

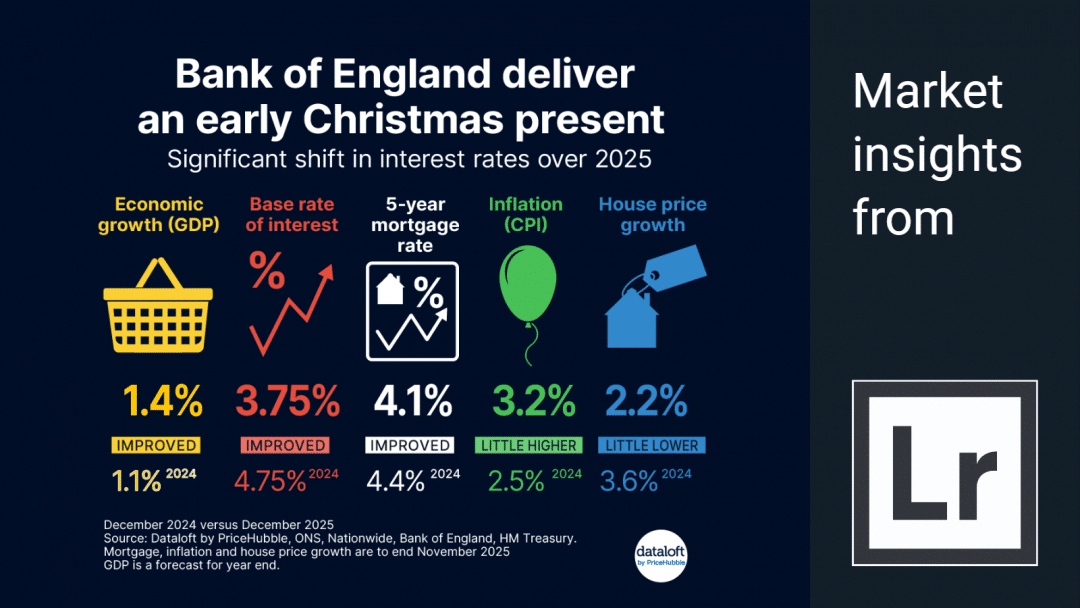

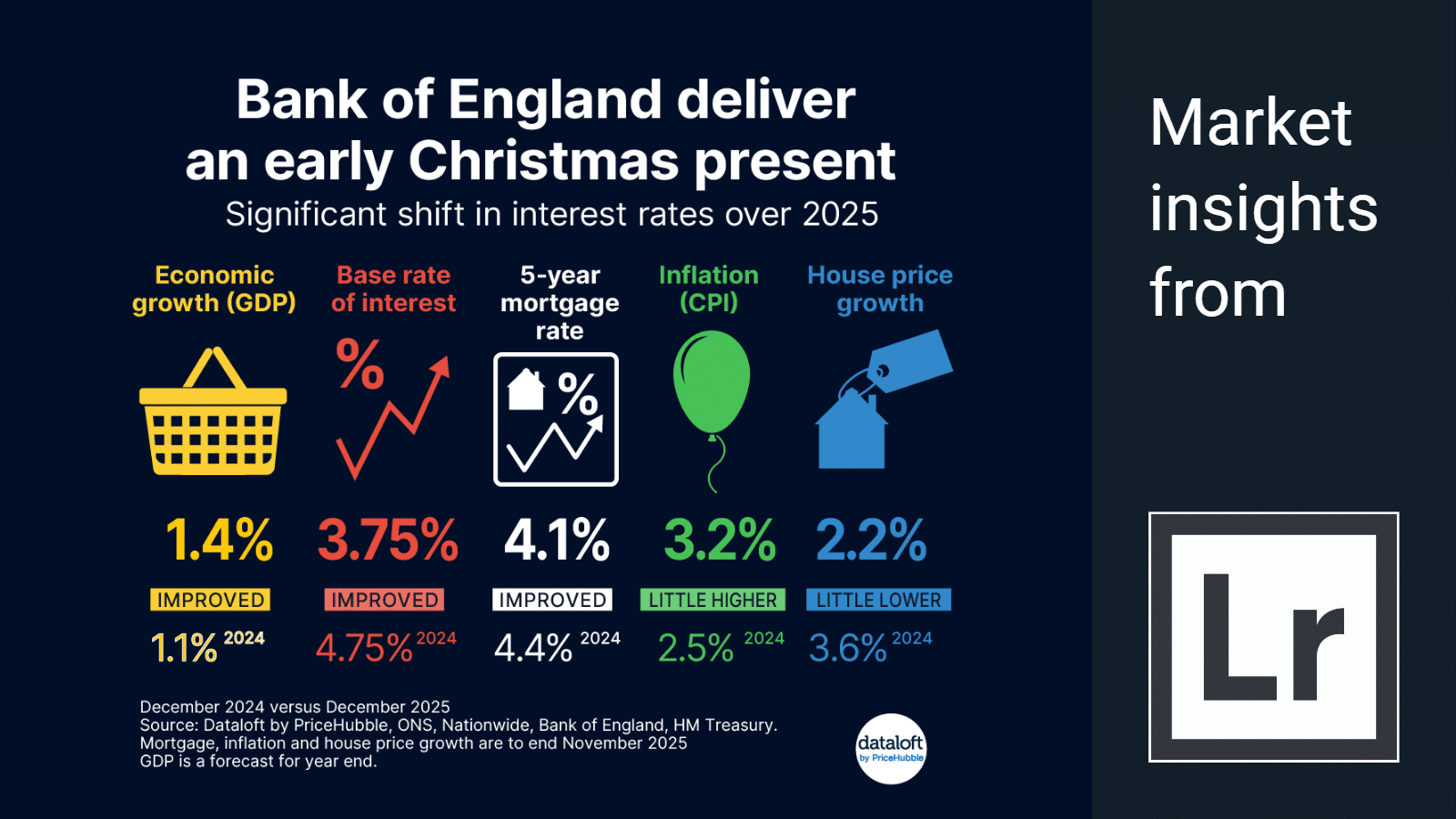

The Bank of England has delivered an early Christmas present, taking the Bank Rate down to 3.75% in its last meeting of the year. Just in time to spread some Christmas cheer. This means that the Bank rate is significantly lower than it was this time last year, when it was 4.75%.

Mortgage rates have been coming down too, with the latest average 5 year fixed rate at 4.1% versus 4.4% a year earlier. Lower interest rates are feeding into improved home ownership affordability.

Alongside interest rates, economic growth is finishing the year stronger than last year too (1.9% anticipated for 2025 versus 1.1% last year).

House prices have stalled a little at the tail end of the year after a strong start, meaning they are finishing a little lower than over 2024. With the budget uncertainty now lifted and improving affordability, there is more scope to see house price growth shift a little higher in the New Year. Source: PriceHubble, ONS, Nationwide, Bank of England, HM Treasury Mortgage, inflation and house price growth are to end November 2025 GDP is a forecast for year end.